Teri Campbell

Data-informed professional healthcare entrepreneur, problem solver, and avid learner with extensive clinical healthcare experience.

LinkedIn Profile

SQL Bank Project

INTRODUCTION

Project description: This project utilized Historical Data for The International Development Association (IDA)

The IDA Statement of Credits and Grants provides data on “publicly guaranteed debt extended by the World Bank Group. The IDA provides developmental credits, grants, and guarantees to its recipient member countries to help meet their development needs. Credits from IDA are at concessional rates. Data are in U.S. dollars calculated using historical rates.”

“The International Bank for Reconstruction and Development (IBRD) lends to governments of middle-income and creditworthy low-income countries.

The International Development Association (IDA) provides interest-free loans – called credits – and grants to governments of the poorest countries.

Together, IBRD and IDA make up the World Bank.”

The goal of this project was to gain insights and a snapshot view from loans (credits) extended by the International Development Association (IDA) though the World Bank Group.

What I Learned

-

India has both the greatest outstanding loan amounts and greatest number of recorded transactions

-

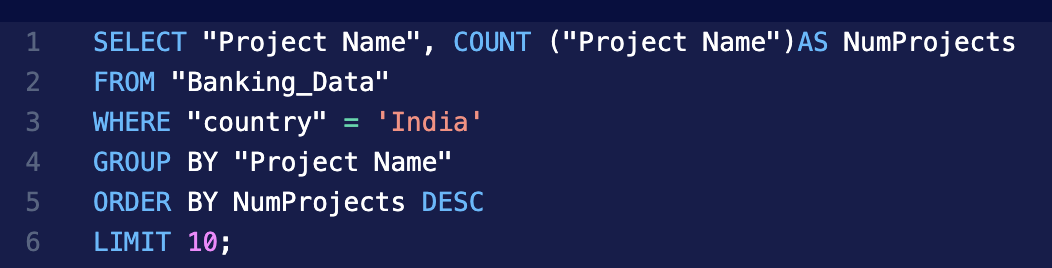

Most loan amounts in India are held by “Controller of Aid Accounts & Audit”

-

Top project categories for loans in India include telecommunications, social safety nets, and infrastructure

-

Despite having the largest outstanding loan totals, India does not appear in the top 10 for longest held loans.

DATA

The “IDA Statement of Credits and Grants-Historical Data” data set was downloaded from world bank.org The data can be found here: https://finances.worldbank.org/Loans-and-Credits/IDA-Statement-Of-Credits-and-Grants-Historical-Dat/tdwh-3krx

Data was cleaned, filtered, and analyzed using PostgreSQL

The data set contained 1,109,994 rows and 30 fields

ANALYSIS

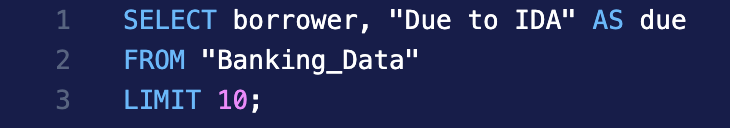

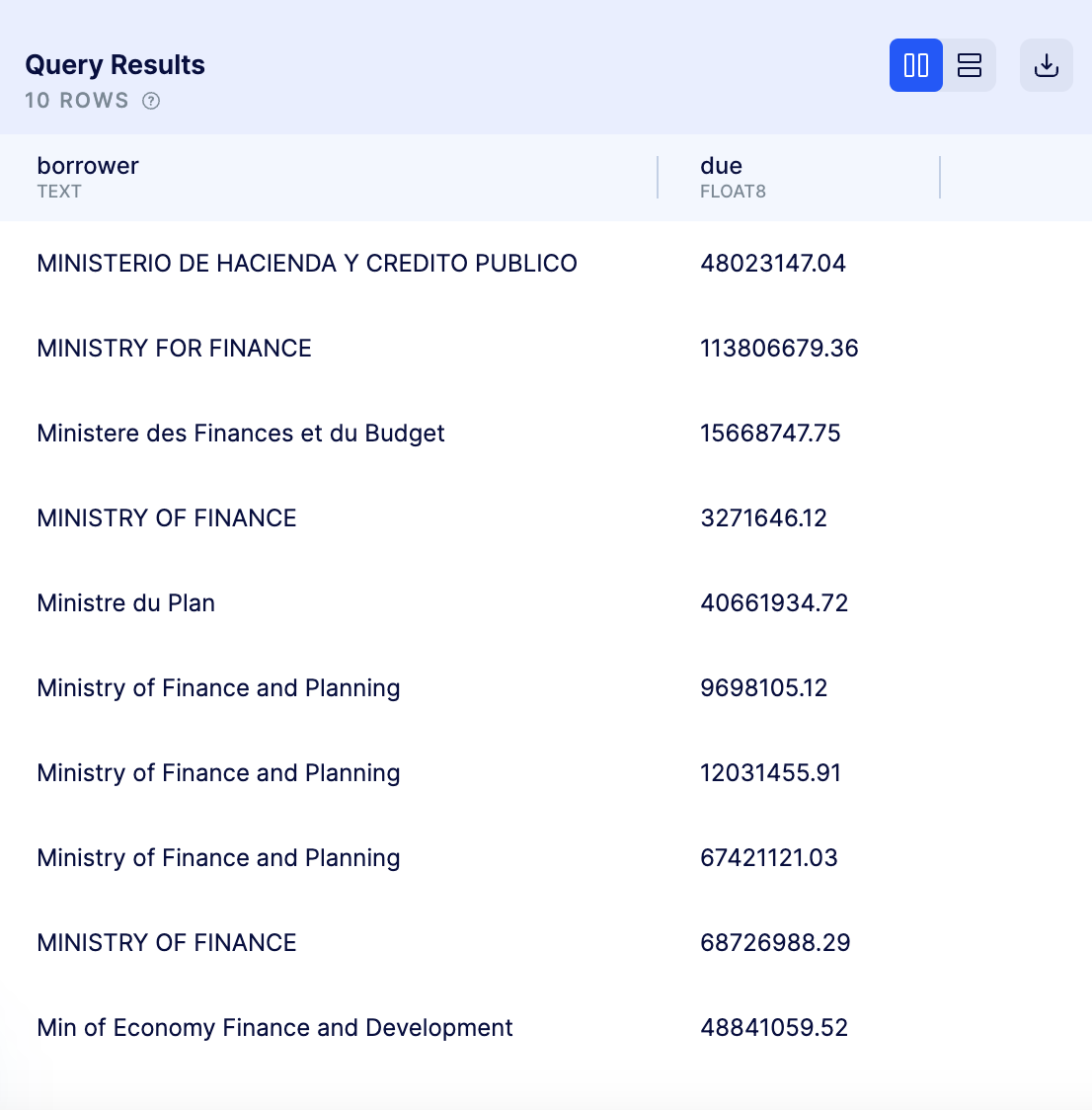

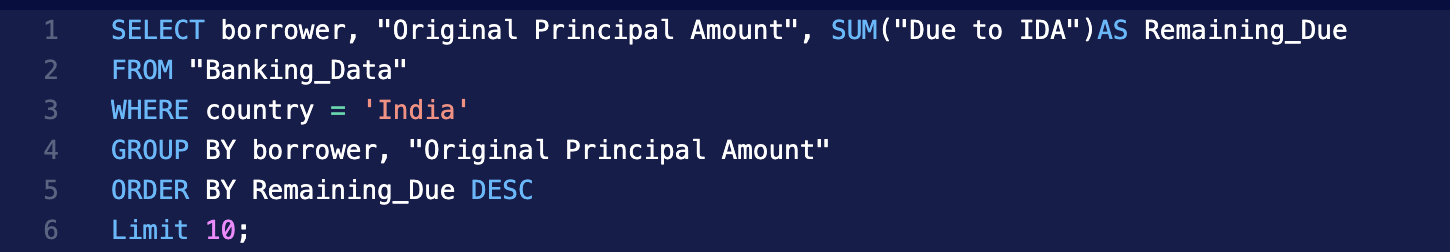

First I wanted to know, what were the greatest amounts due?

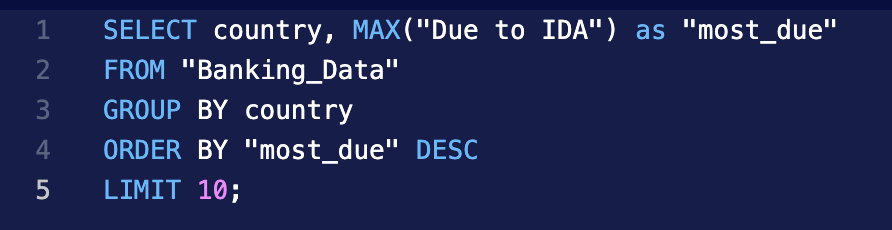

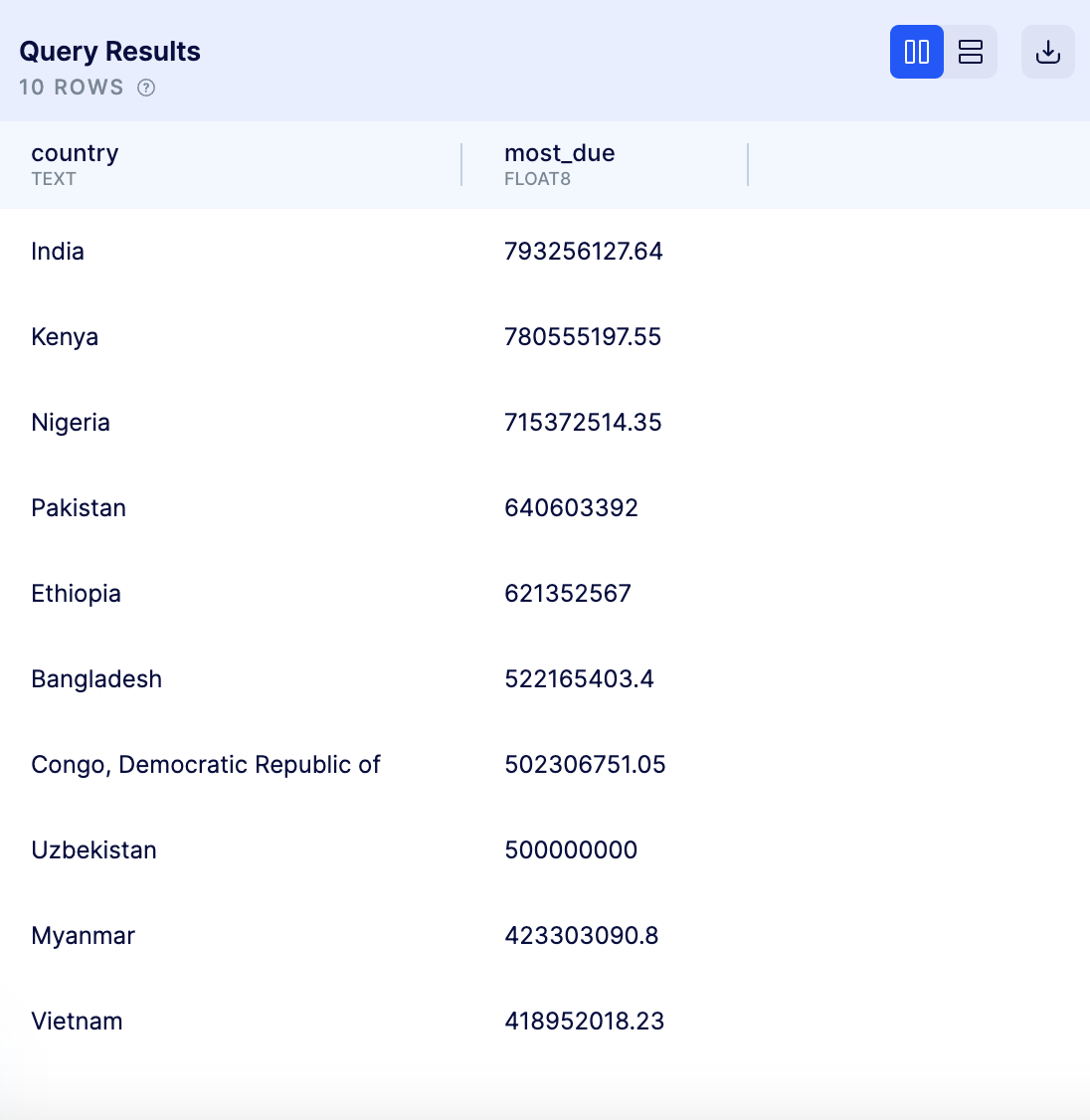

Then which countries had the greatest outstanding amount?

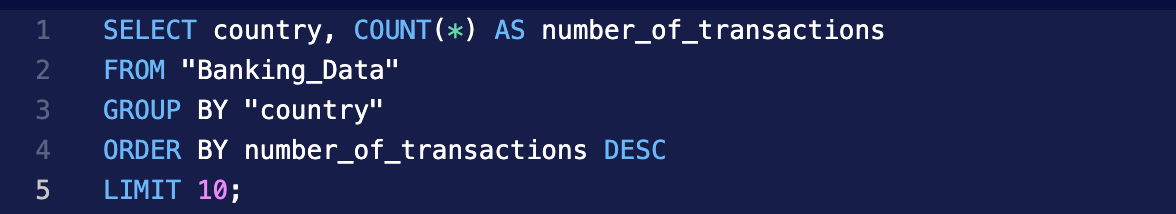

Which countries had the greatest number of transactions?

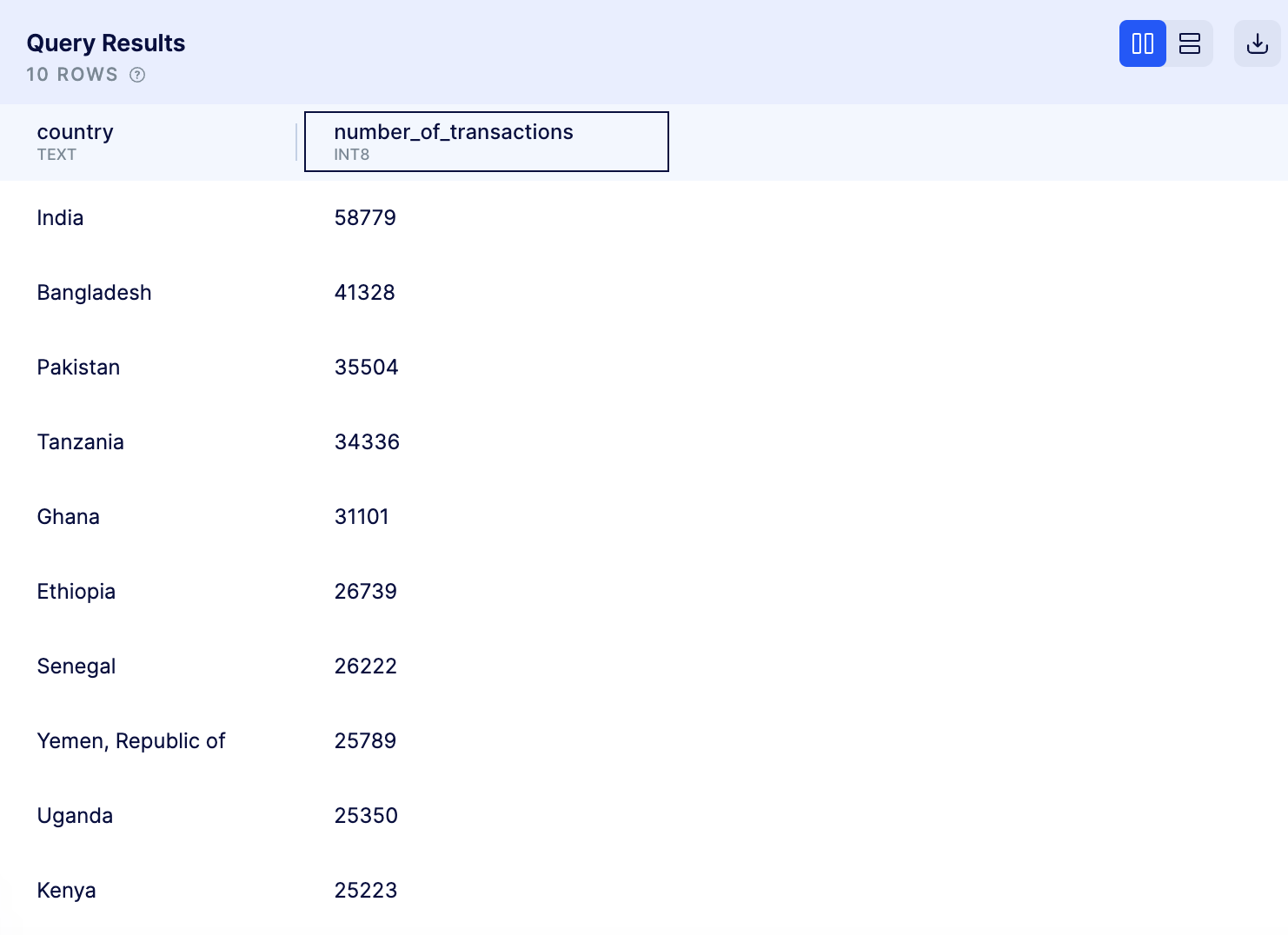

Looking deeper, here are the top project categories in India, which was found to have the most outstanding loan amounts

Which entity or entities hold the most loan amounts in India?

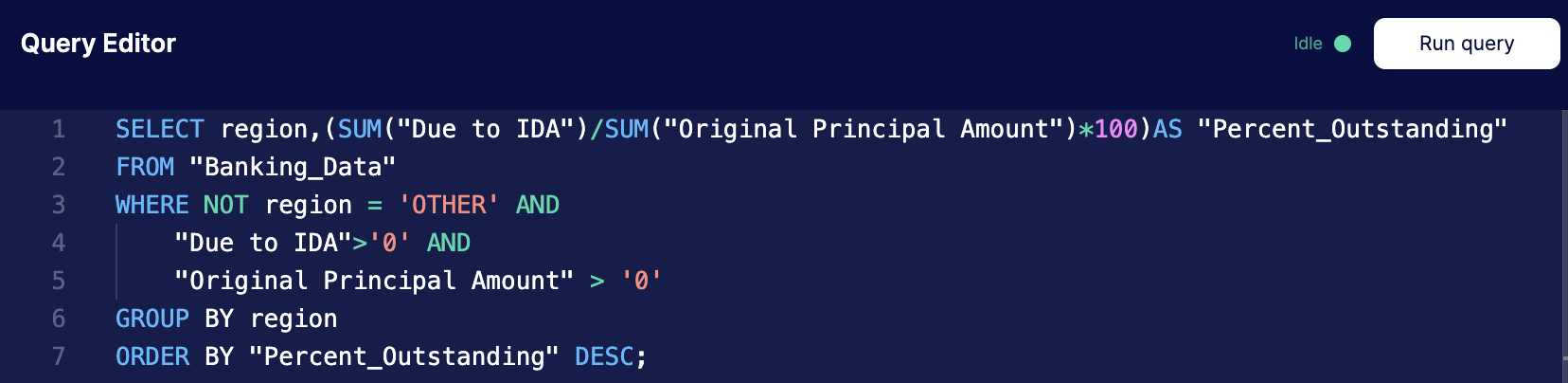

Zooming back out; What percentage of the original loan amount remains unpaid by region?

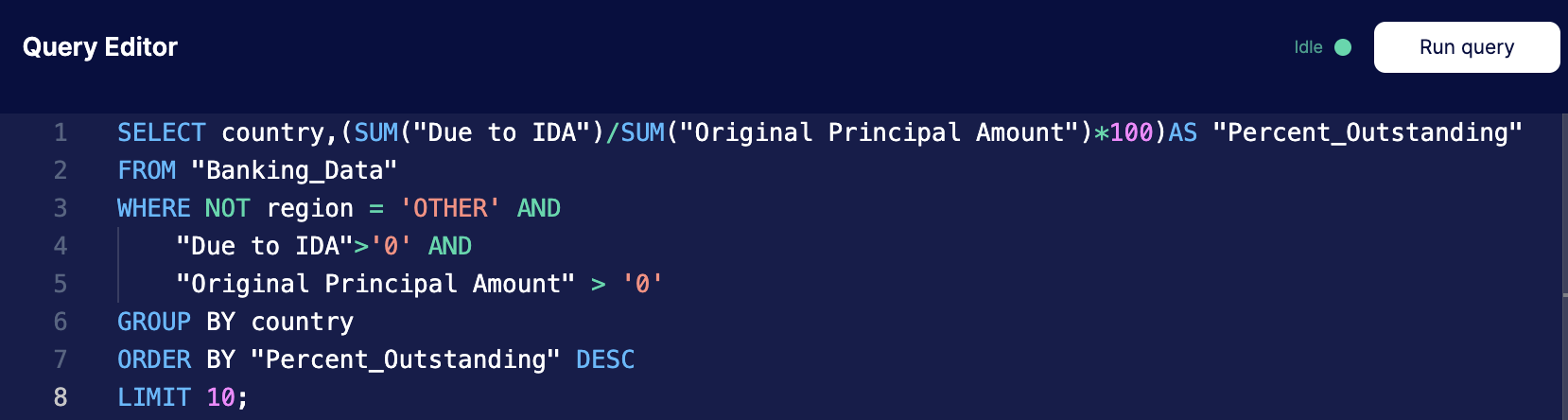

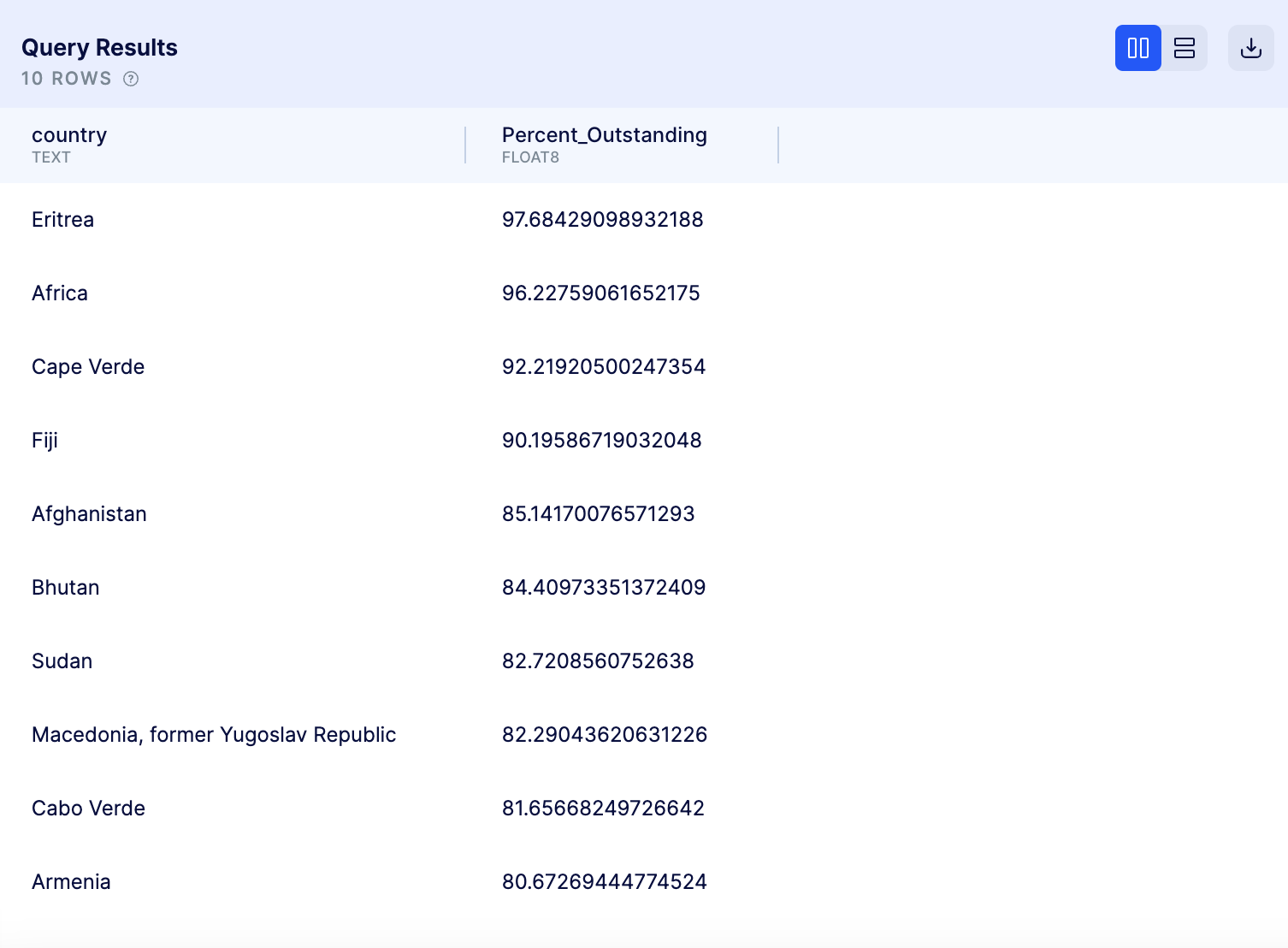

Are the top percentages of unpaid loan amounts in India?

Looks like they are not

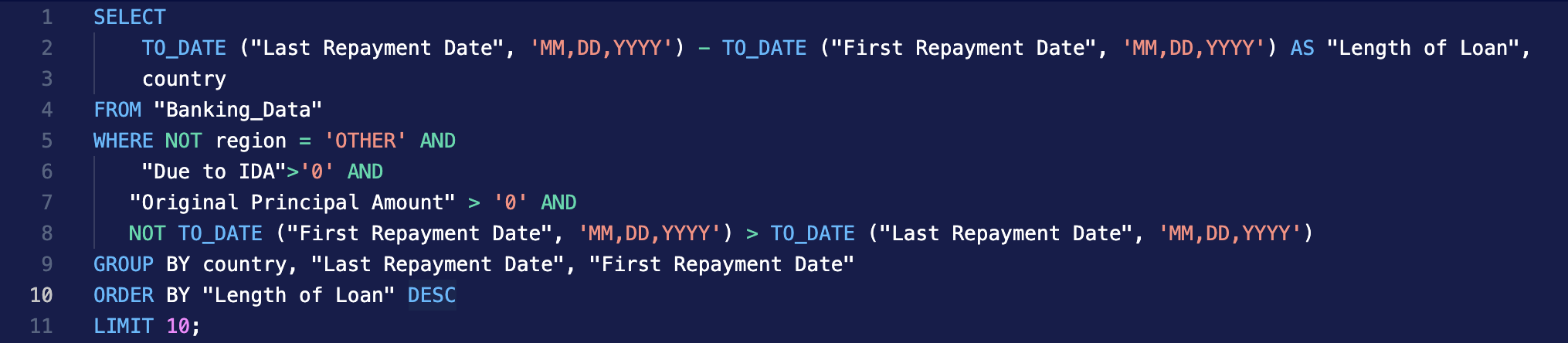

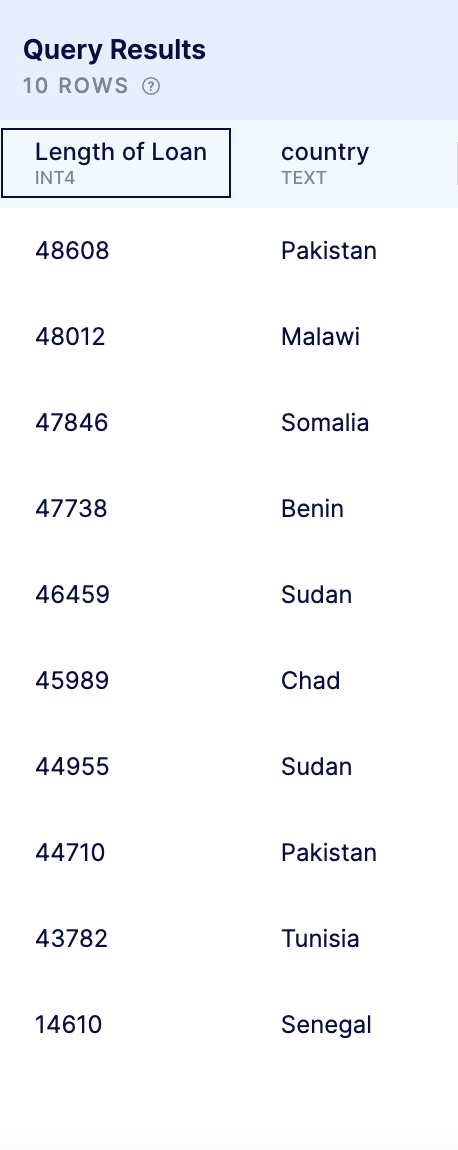

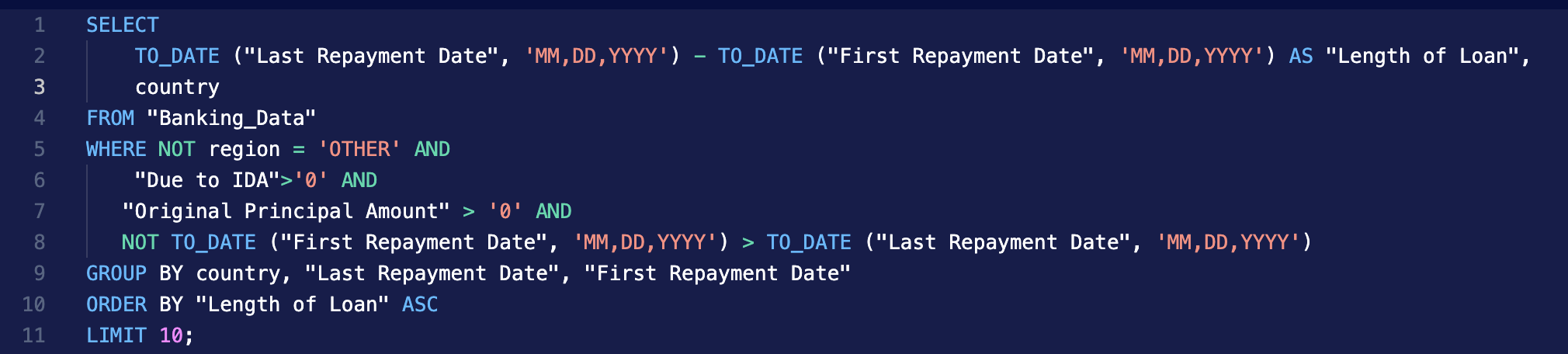

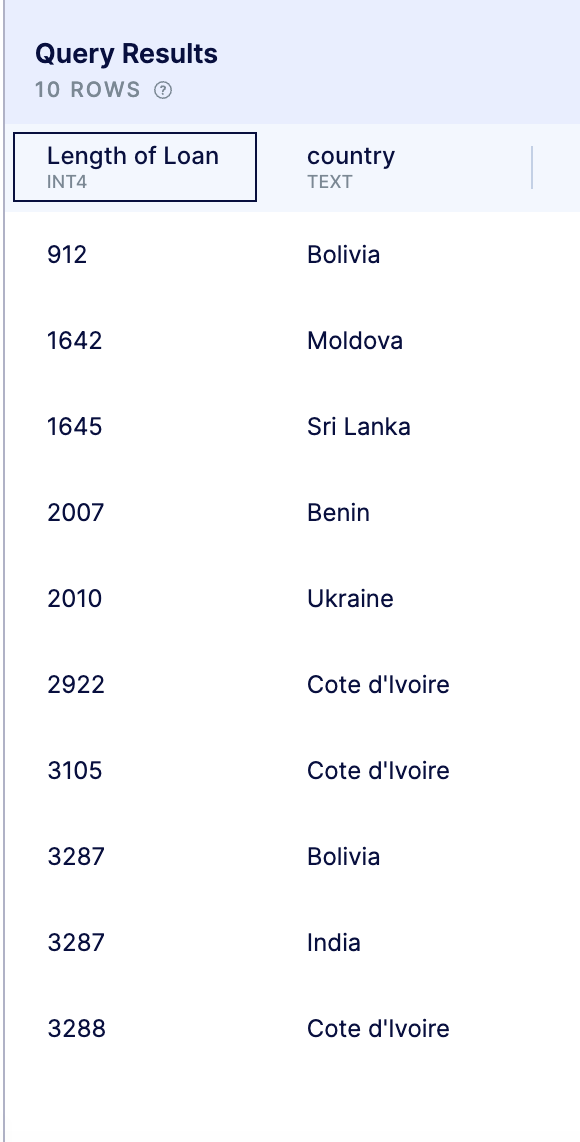

Finally, I explored which countries had the longest and shortest scheduled loan durations

RESULTS AND RECOMMENDATIONS

The above analysis reveals the following:

- India has the greatest outstanding loan amounts

- India also has the largest number of transactions

- Top project categories for loans in India include telecommunications, social safety nets, and infrastructure

- The greatest loan amounts in India are held by the Controller of Aid Accounts & Audit

- India does not appear in the top 10 for longest loan duration; In fact, India appears once in 9th place for the shortest duration loan.

CONCLUSION AND RECOMMENDATIONS

The above insights could be used to further the stated goal of helping meet developing countries needs.

Following trends over time for countries receiving loans could reveal successes and failures in the lending process and is worth further exploration.

Further research to understand barriers met by loan recipients could provide deeper understanding of each regions specific needs.